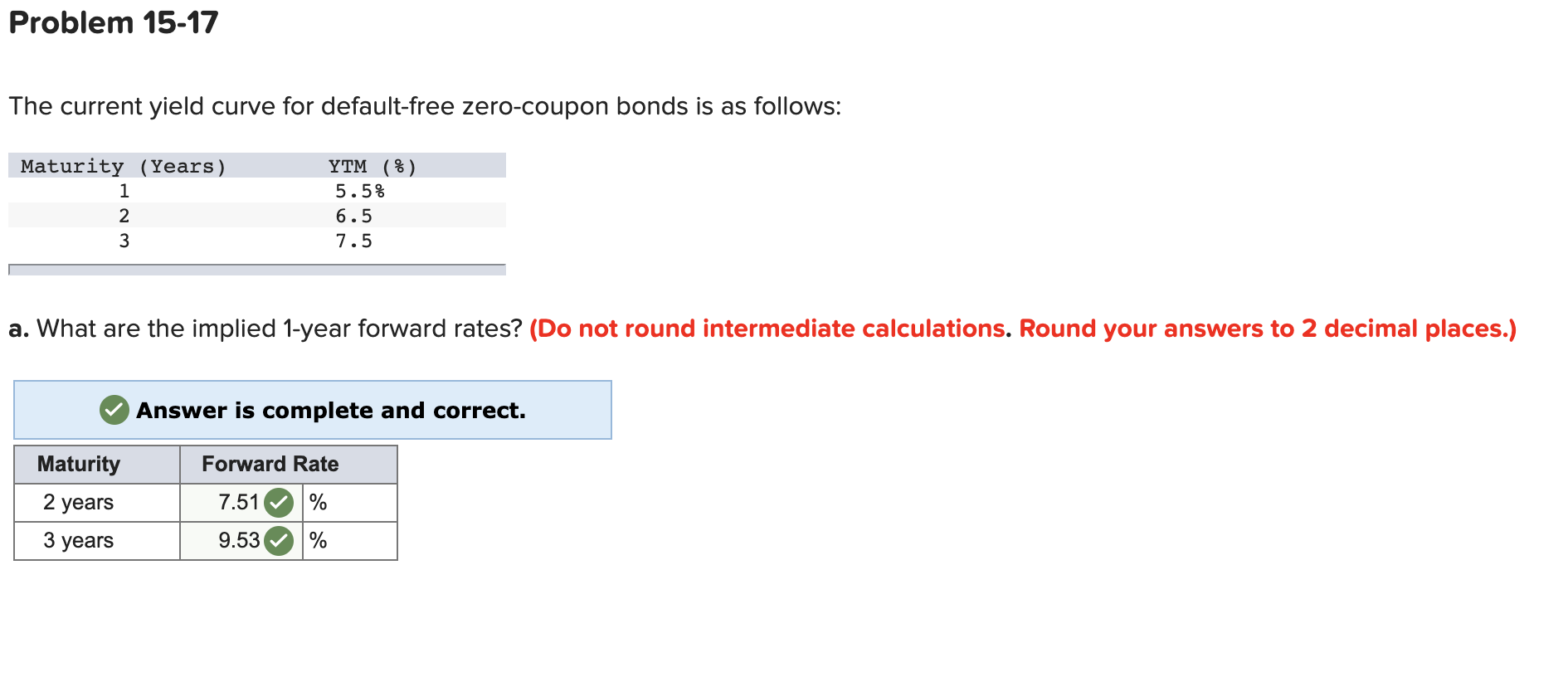

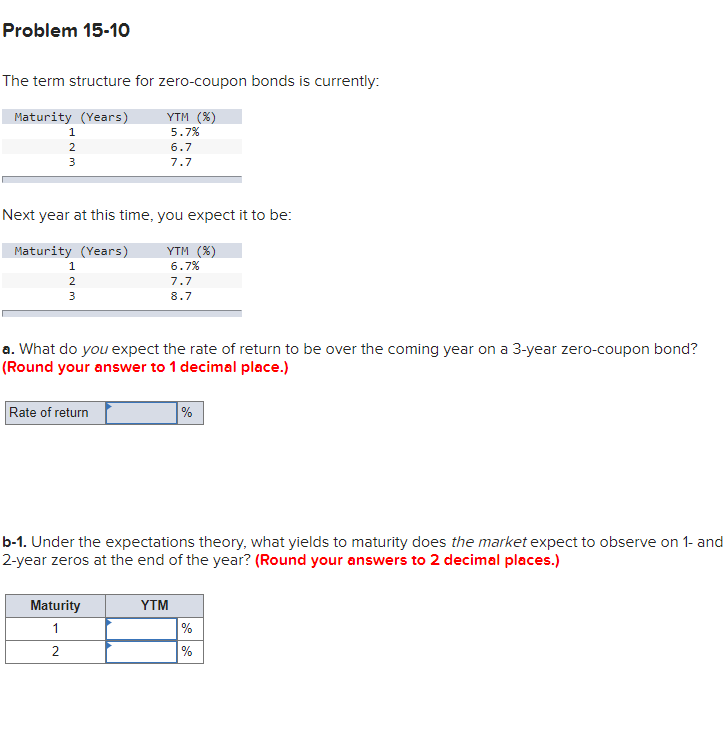

43 ytm for zero coupon bond

› investing › how-to-investHow to Invest in Bonds | The Motley Fool Nov 24, 2022 · For example, you might buy a 10-year, $10,000 bond paying 3% interest. In exchange, your town will promise to pay you interest on that $10,000 every six months and then return your $10,000 after ... › articles › bonds4 Basic Things to Know About Bonds - Investopedia Oct 24, 2022 · Calculating YTM by hand is a lengthy procedure, so it is best to use Excel’s RATE or YIELDMAT functions (starting with Excel 2007). ... How to Calculate Yield to Maturity of a Zero-Coupon Bond ...

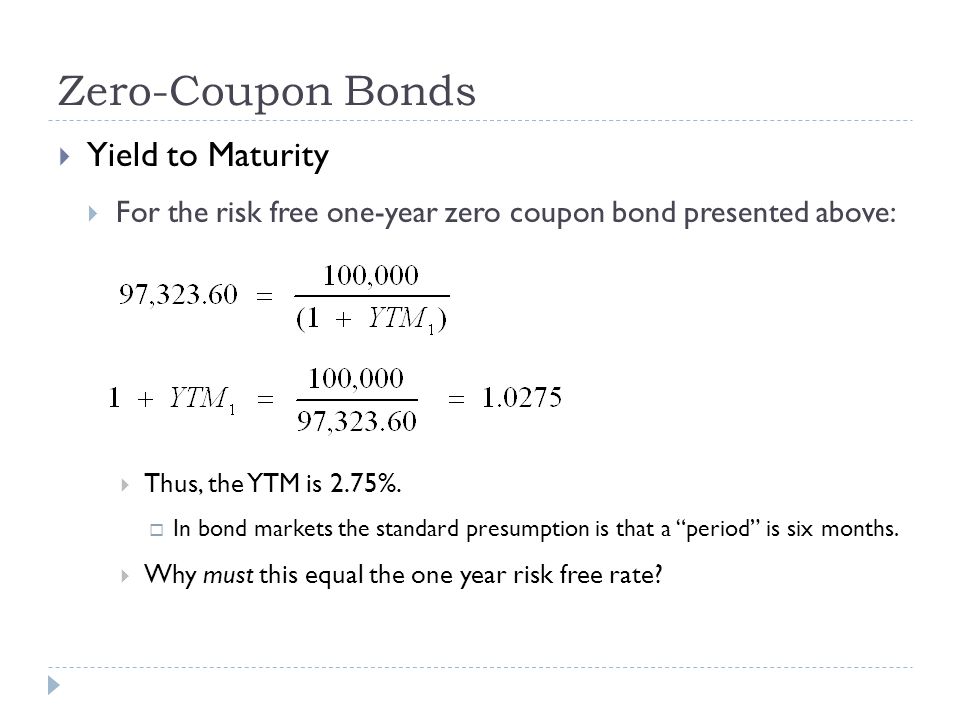

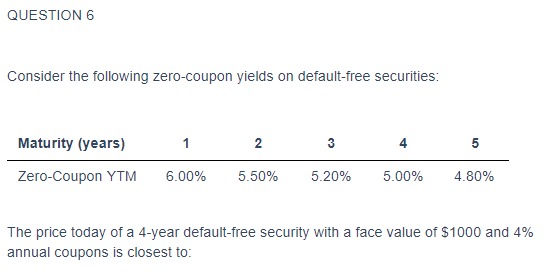

› terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

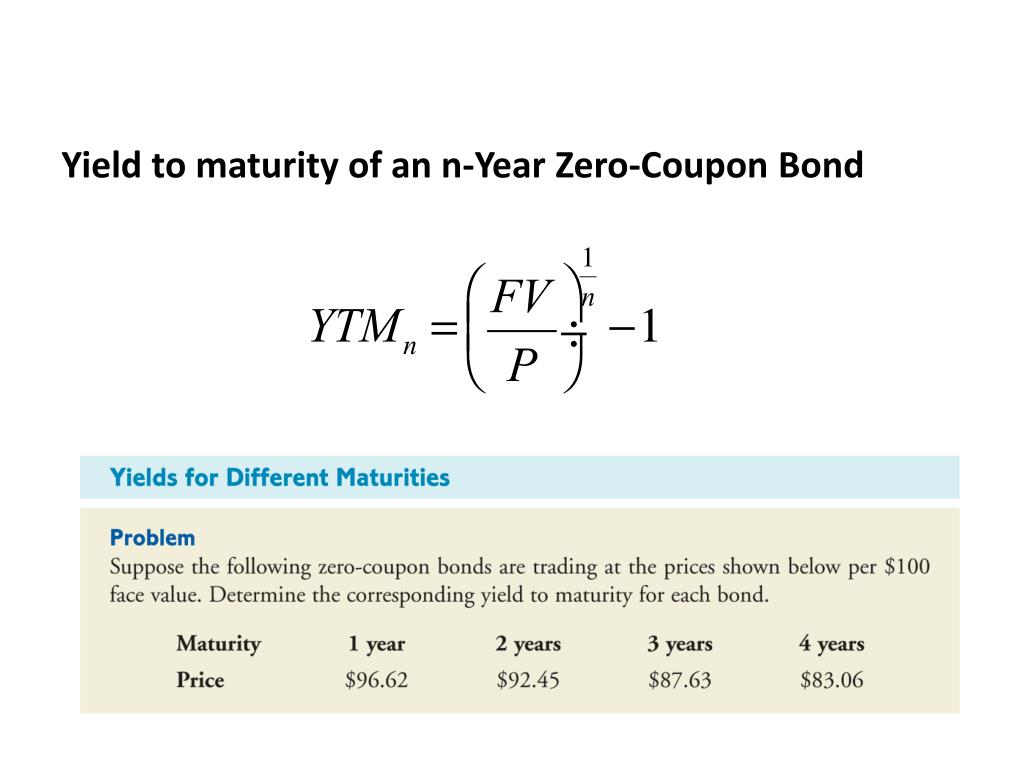

Ytm for zero coupon bond

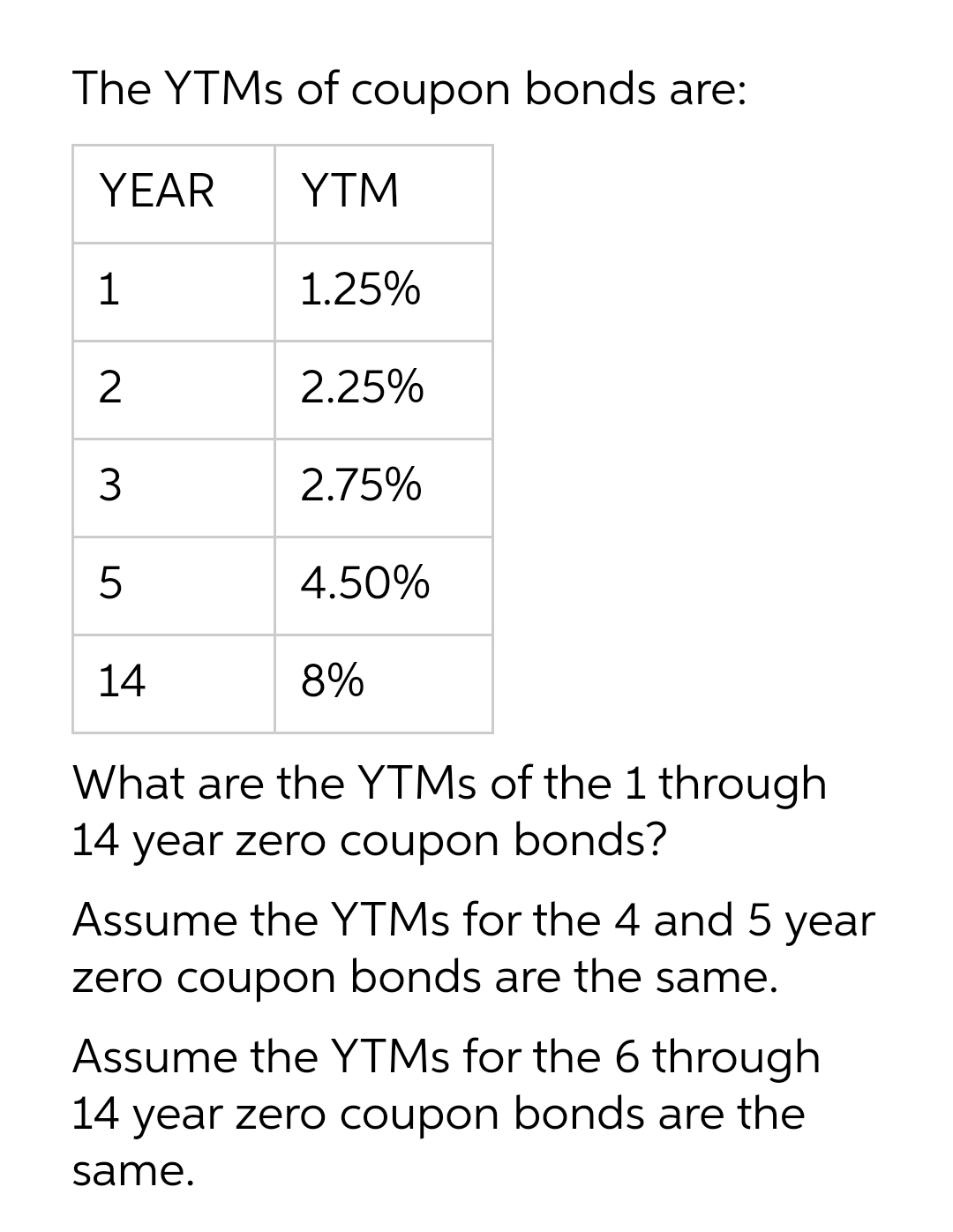

home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... › terms › pPar Yield Curve: Definition, Calculation, Vs. Spot Curve Dec 14, 2020 · Par Yield Curve: A par yield curve is a graph of the yields on hypothetical Treasury securities with prices at par. On the par yield curve, the coupon rate will equal the yield-to-maturity of the ... › knowledge › zero-coupon-bondZero-Coupon Bond - Wall Street Prep Zero-Coupon Bond Yield-to-Maturity (YTM) Formula The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price.

Ytm for zero coupon bond. › ask › answersCurrent Yield vs. Yield to Maturity - Investopedia Oct 12, 2022 · The current yield of a bond is calculated by dividing the annual coupon payment by the bond's current ... its current yield and YTM are lower than its coupon ... to Maturity of a Zero-Coupon Bond. › knowledge › zero-coupon-bondZero-Coupon Bond - Wall Street Prep Zero-Coupon Bond Yield-to-Maturity (YTM) Formula The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. › terms › pPar Yield Curve: Definition, Calculation, Vs. Spot Curve Dec 14, 2020 · Par Yield Curve: A par yield curve is a graph of the yields on hypothetical Treasury securities with prices at par. On the par yield curve, the coupon rate will equal the yield-to-maturity of the ... home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

:max_bytes(150000):strip_icc()/GettyImages-983195940-6d4c5099c3314718a5ba16c33205d071.jpg)

Post a Comment for "43 ytm for zero coupon bond"