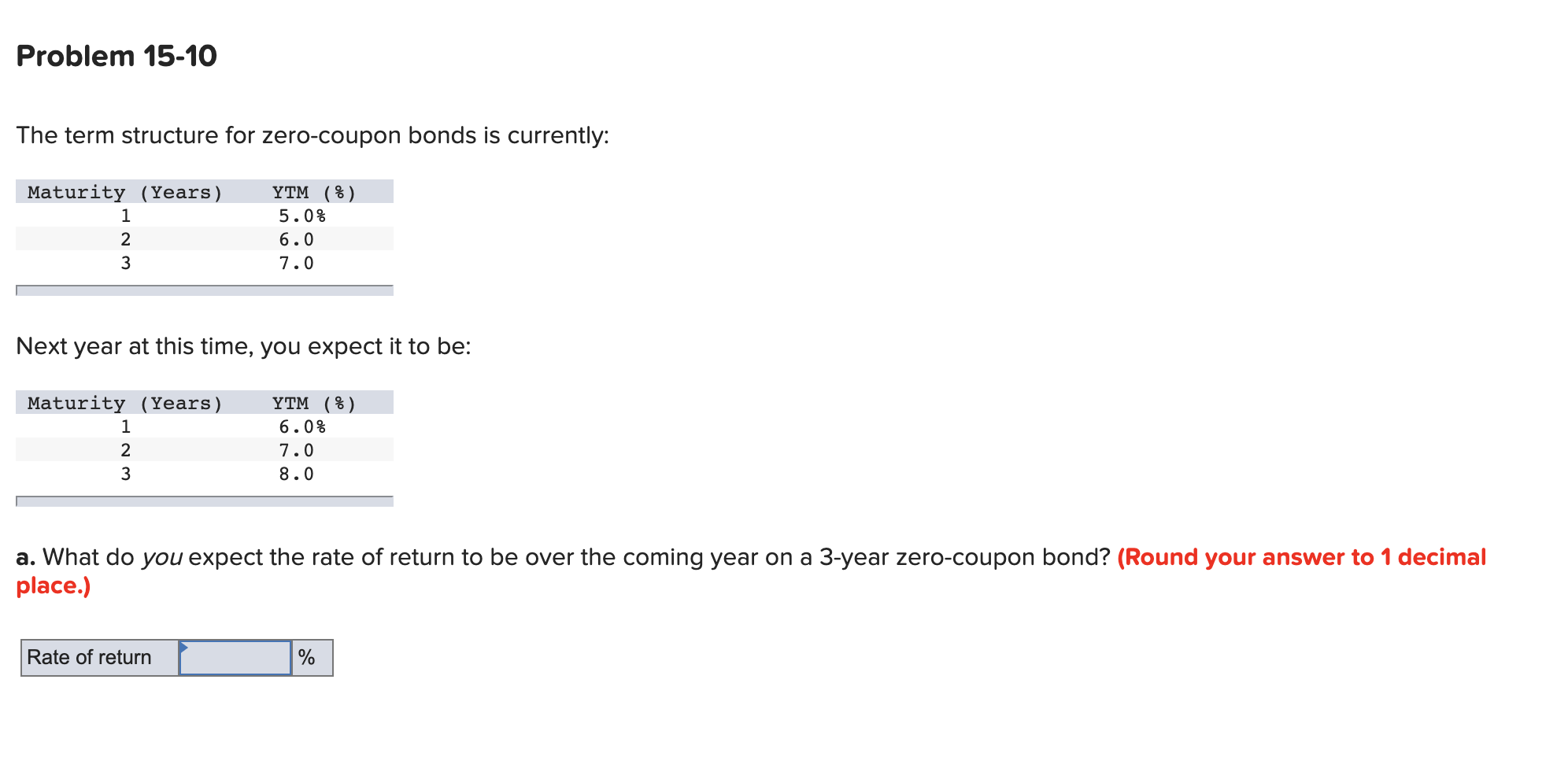

39 what is zero coupon

Zero-Coupon CDs: What Are They & How Do They Work? Zero-coupon CDs are certificates of deposit purchased at a lower price with no monthly interest payments. Instead, the investor receives the CD at face value at the maturity date. While this kind of CD can be a great investment for the right person, zero-coupon CDs also come with some downsides to keep in mind. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 ... With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount ...

en.wikipedia.org › wiki › Zero-Coupon_InflationZero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI). It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.

What is zero coupon

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly... Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww What is Zero Coupon Bond? Zero Coupon Bond, also known as the discount bond, is purchased at a discounted price and does not pay any coupons or periodic interests to the fundholders. Money invested in Zero Coupon Bond does not generate a regular interest during the tenure. Coupon zéro : définition et fonctionnement - Ooreka Les obligations a coupon zéro ne distribuent aucun intérêt durant toute leur durée de vie. Les coupons sont capitalisés et versés dans leur intégralité à ...

What is zero coupon. BREEZE Battery Operated Portable Air Conditioner ZERO BREEZE Air Conditioner can work with power supplied through a standard adapter. It can be used as a home air conditioner, also it can work as a car air conditioner, a Tent air conditioner through connecting with a power source or portable power source with 24V, 10A power supplied. How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ... What Is a Zero Coupon Yield Curve? - Smart Capital Mind The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity. What Is a Zero Coupon Swap? - Smart Capital Mind A traditional zero coupon swap places the risk on the party paying the floating payments, and the structure and risk of such makes them similar to a loan agreement. Swaps happen on the over-the-counter market, where parties are more vulnerable to nonpayment. Alternative payment methods can be arranged to minimize or transfer risk.

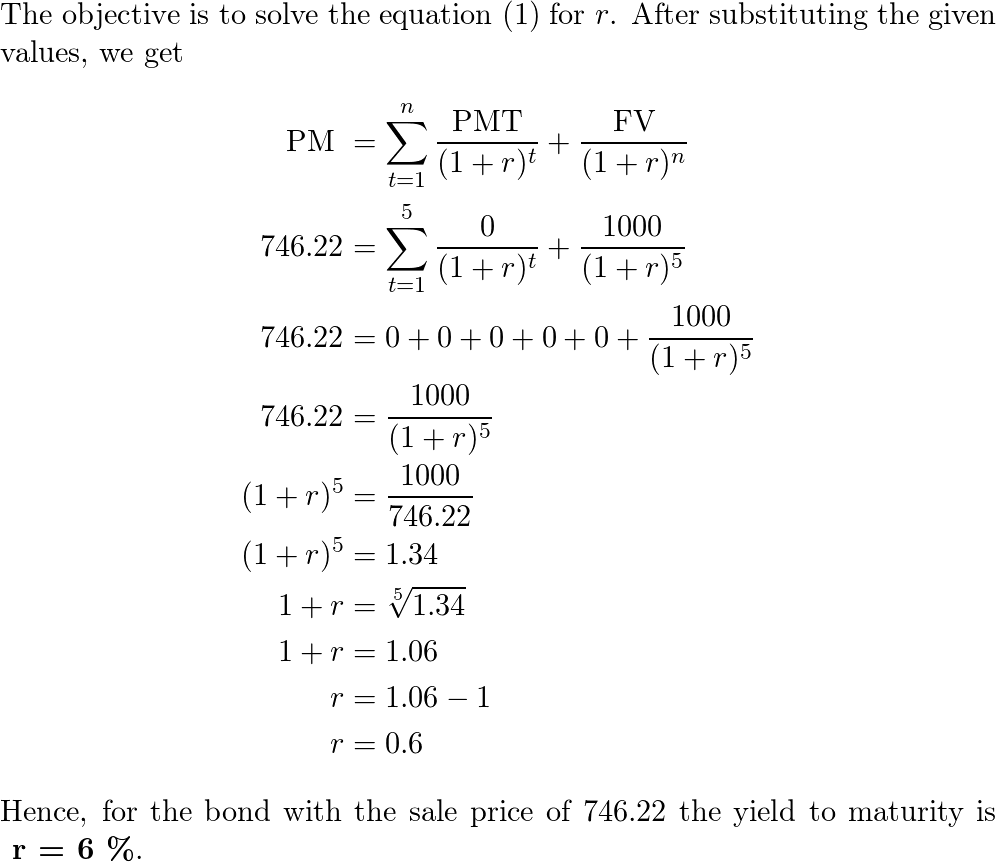

MC Explains | What is a 'zero-coupon, zero-principal' instrument? According to the gazette notification, "zero coupon zero principal instrument" is an instrument issued by a not-for-profit organisation that will be registered with the social stock exchange... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value. Zero Coupon Bond Calculator - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Zero Coupon Bond: Definition, Features & Formula What Is a Zero-Coupon Bond? A zero-coupon bond is a debt asset that trades at a big discount and earns money when redeemed for its full face value at maturity but does not pay interest.. A zero-coupon bond is also known as an accrual bond or a discount bond. Some bonds are issued as zero-coupon securities right away, while others become zero-coupon securities after being decoupled from their ...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Since zero coupon bonds do not pay a coupon, any capital appreciation remains in the bond. Since they sell at a discount to their stated maturation value they are known as discount bonds. In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments. dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ What is a zero coupon bond? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds What does it mean if a bond has a zero coupon rate? - Investopedia A zero coupon bond generally has a reduced market price relative to its par value because the purchaser must maintain ownership of the bond until maturity to ... Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A zero coupon bond, sometimes referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments and instead pays one lump sum at maturity. The amount paid at maturity is called the face value. The term discount bond is used to reference how it is sold originally at a discount from its face value instead of ...

The Tax Advantages of Zero Coupon DSTs - Kay Properties A Zero Coupon DST is used as a 1031 Exchange investment alternative in certain unique situations that require sophisticated tax strategies. For example, some property owners repeatedly refinance a property during the hold period and pull equity out for other purposes.

What are Zero-coupon Bonds? Zero-coupon bonds, also known as discount bonds, are debt securities that investors obtain at steep discounts on the face value of the bond. This type of bond does not pay any interest during its lifetime. Rather, zero-coupon bonds release the returns at maturity in the form of a lump sum, which is the full face value of the bond.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

› knowledge › zero-coupon-bondZero-Coupon Bonds: Characteristics and Calculation A Zero-Coupon Bond is priced at a discount to its face (par) value with no periodic interest payments from the date of issuance until maturity. Zero-Coupon Bond Features How Do Zero Coupon Bonds Work? Zero-coupon bonds, also known as "discount bonds," are sold by the issuer at a price lower than the face (par) value that is repaid at maturity.

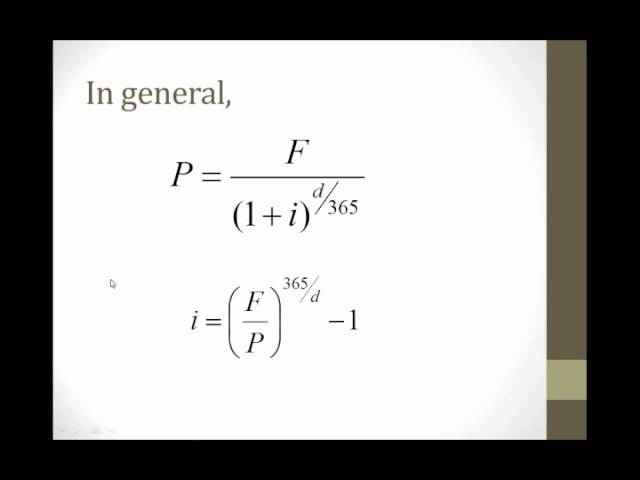

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

› terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

Zero Coupon Bonds Explained (With Examples) - Fervent Zero Coupon Bonds, aka "Deep Discount Bonds", or "ZCBs" are bonds (a type of debt instrument) that don't pay any coupons (aka interest). In other words, there is no coupon payment (aka interest payment). They pay a zero coupon. Hence the name, zero coupon bond. The only thing they do pay is the Par (aka "face value") when the bond matures.

What Is a Zero-Coupon CD? - The Balance A zero-coupon CD is a CD you purchase at a much lower rate. You won't have the option to receive regular interest payments; instead, you'll receive the entire value of the CD and any accumulated interest once it reaches full maturity. If you don't need immediate access to the funds, a zero-coupon CD can be a good long-term savings strategy.

it.wikipedia.org › wiki › Obbligazione_zero-couponObbligazione zero-coupon - Wikipedia Un'obbligazione zero-coupon (nota anche come Zero-Coupon Bond, abbreviato ZCB) è un'obbligazione il cui rendimento è calcolato come differenza tra la somma che il sottoscrittore riceve alla scadenza e la somma che versa al momento della sottoscrizione. Il nome deriva dal non pagamento di interessi (cioè niente cedole, inglese: coupon).

Zero-Coupon CDs: What They Are And How They Work | Bankrate This type of deposit account is called "zero coupon" because "coupon" refers to a periodic interest payment and "zero" indicates that it does not incorporate such payments. How...

Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

What is a Zero Coupon Bond? Who Should Invest? | Scripbox A zero coupon bond is a type of fixed income security that does not pay any interest to the bondholder. It is also known as a discount bond. These bonds are issued at a discount to the face value. In other words, it trades at a deep discount. On maturity, the bond issuer pays the face value of the bond to the bondholder.

Zéro-coupon - Wikipédia Une obligation à coupon zéro est un titre dont la rémunération est constituée exclusivement par l'écart entre son prix d'émission et son prix de ...

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

What is zero coupon bonds? - Zaviad A zero coupon bond is a debt security that doesn't pay periodic interest payments (coupons) to the bondholder. Instead, the bondholder receives the entire principal amount of the bond at maturity. For this reason, zero coupon bonds are also known as "discount" bonds, since the purchase price is lower than the face value of the bond.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks What is a zero-coupon bond? Typically, bondholders make a profit on their investment through regular interest payments, made annually or semi-annually, known as "coupon payments." But as the...

Coupon zéro : définition et fonctionnement - Ooreka Les obligations a coupon zéro ne distribuent aucun intérêt durant toute leur durée de vie. Les coupons sont capitalisés et versés dans leur intégralité à ...

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww What is Zero Coupon Bond? Zero Coupon Bond, also known as the discount bond, is purchased at a discounted price and does not pay any coupons or periodic interests to the fundholders. Money invested in Zero Coupon Bond does not generate a regular interest during the tenure.

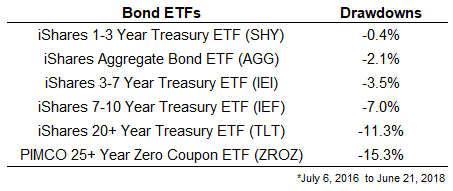

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly...

Post a Comment for "39 what is zero coupon"