44 zero coupon bonds tax

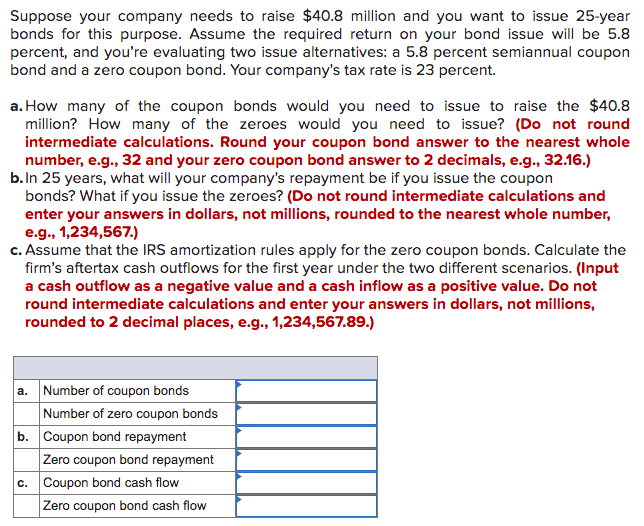

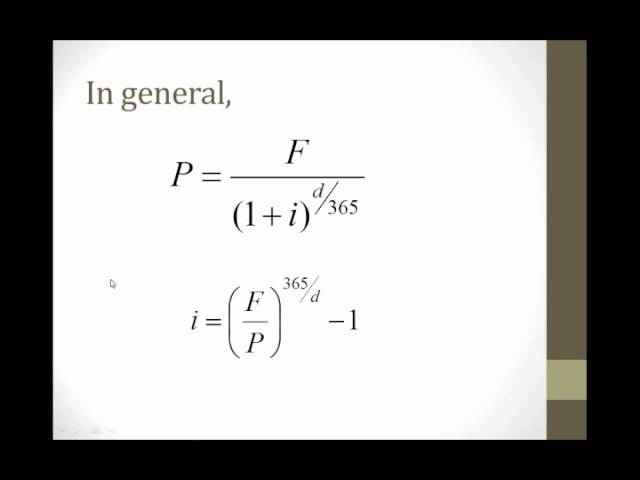

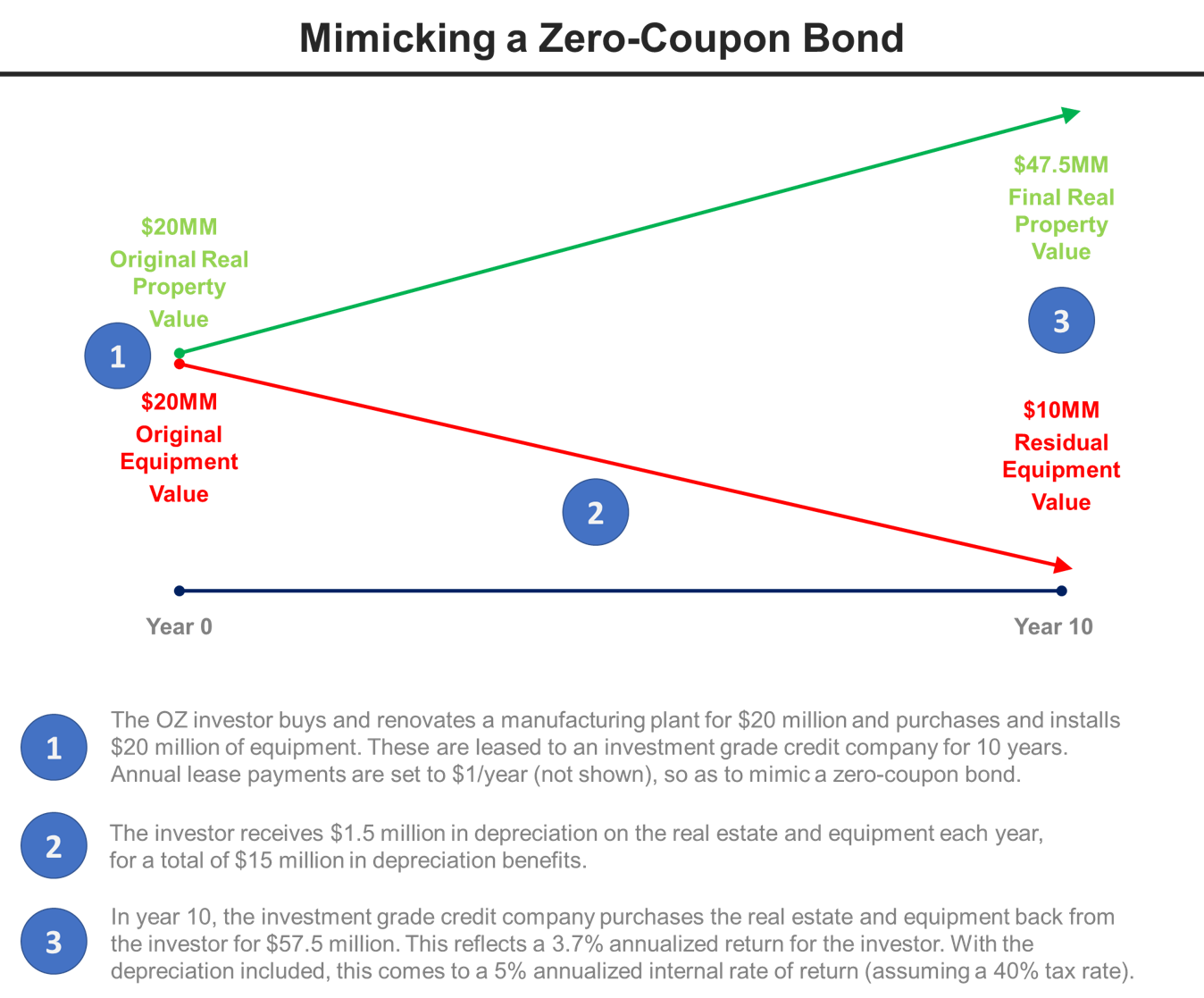

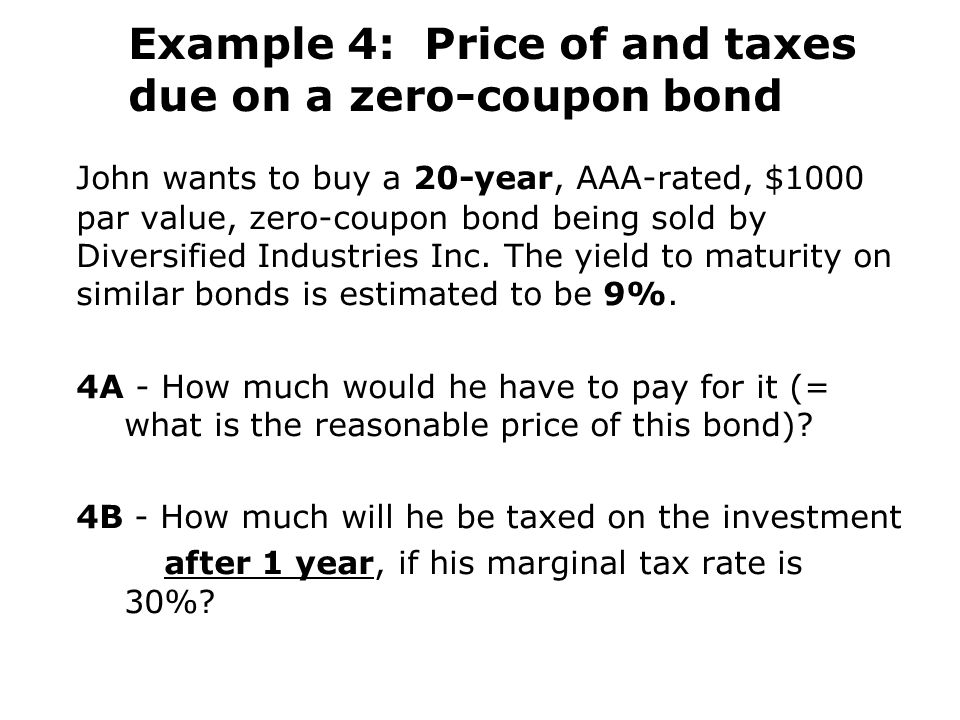

› glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ... Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

en.wikipedia.org › wiki › United_States_TreasuryUnited States Treasury security - Wikipedia Series I bonds are the only ones offered as paper bonds since 2011, and those may only be purchased by using a portion of a federal income tax refund. Zero-Percent Certificate of Indebtedness. The "Certificate of Indebtedness" (C of I) is issued only through the TreasuryDirect system. It is an automatically renewed security with one-day ...

Zero coupon bonds tax

› terms › zZero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... › money › income-taxZero Coupon Bonds: Know tax rules when such a bond is held ... Sep 22, 2022 · The tax rules change, depending on the holding period, amount of gains or loss. In bond terms, coupon rate means the rate of interest offered on a bond. As the coupon rate of a zero coupon bond is ... How Are Corporate Bonds Taxed? - Investopedia On the other hand, there are zero-coupon bonds that have tax implications. These bonds are sold at a deep discount, relative to other bonds as they do not pay any interest or coupons. At maturity ...

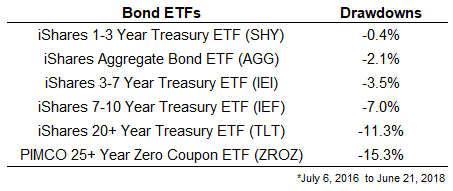

Zero coupon bonds tax. What are Zero Coupon Bonds? Who Should Invest in Them? - ClearTax Long-term zero coupon bonds are generally issued with maturities of 10 to 15 years. There is an inverse relationship between the time and the maturity value of a zero coupon bond. The longer the length until a zero-coupon bonds maturity date the less the investor generally has to pay for it. Zero coupon bonds with a maturity of less than a year ... How Are Municipal Bonds Taxed? - Investopedia However, most zero-coupon municipal bonds are sold in denominations of $5,000. Either way, you're buying at a tremendous discount. This, in turn, allows you to buy more bonds if you so desire. Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips Note: Muni bonds exempt from federal, state, and local taxes are known as "triple tax exempt." Zero-coupon bonds. Zero-coupon bonds are a special case. You might have to pay tax on their interest ... › articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ...

Zero Coupon 2025 Fund | American Century Investments 2012 Tax Form 8937 ... Invests in zero-coupon bonds, providing a dependable rate of return if held to maturity. Performance. ... Each Zero Coupon fund invests in different maturities of these debt securities and has different interest rate risks. The fund can only offer a relatively predictable return if held to maturity. What is the tax implication on zero coupon bonds? Updated. Any long term capital gain on sale of zero coupon bonds shall be charged to tax at minimum of the following: 20% of LTCG After indexation of cost of such bonds or 10% of LTCG before indexation of cost of such bonds. Zero coupon bonds, Investing in Zero Coupon Bonds, Tax Considerations for Zero Coupon Bonds Explained the tax implication ... › ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · Zero-coupon bonds do not pay interest at regular intervals. Instead, z-bonds are issued at a discount and mature to their face value. ... The IRS mandates a zero-coupon bondholder owes income tax ... Zero Coupon Bonds: Know tax rules when such a bond is held till ... As the coupon rate of a zero coupon bond is zero per cent, people investing in such bonds don't get regular interest, but get a deep discount on face value at the time of issuance of such a bond.

Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom What is the tax treatment for Zero Coupon Bonds? Zero coupon bonds that are notified and issued by REC and NABARD are taxable. Earnings from zero coupon bonds are also subject to capital gains tax at the time of maturity. The earnings or capital appreciation for zero coupon bonds is the difference between the maturity value and purchase price ... How Are Treasury Bills (T-Bills) Taxed? - Investopedia After federal taxes, your net earnings from the Treasury bill will be only 0.053%, or 0.07% x (100% - 24%). But the tax rate on the CD is higher since it also includes state taxes. You would only ... › knowledge › zero-coupon-bondWhat are Zero-Coupon Bonds? (Characteristics and Examples) Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula Tax on Bonds: Know the tax implications when a convertible bond is ... Zero Coupon Bonds: Know tax rules when such a bond is held till maturity, sold early. However, when such shares are sold off, capital gains tax would be applicable and for the purpose of computing ...

Zero coupon bonds: know the tax rules when such a bond is held to ... Related posts 7 Amazing 'Strong Buy' Stocks That Offer Safety and Big Dividends for Passive Income - 24/7 Wall St. 22.09.2022 Bitcoin, Ethereum, Crypto News, and Price Data - CoinDesk 22.09.2022 In terms of bonds, the coupon rate refers to the interest rate offered on a bond. Since the coupon rate of a zero-coupon bond […]

What Is a Zero-Coupon Bond? | The Motley Fool Finally, although also similar to regular bonds, zero-coupon bonds can either be government-issued, corporate, or municipal. Depending on the issuer, zero-coupon municipal bonds may generate tax ...

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1. Here are some general characteristics of zero coupon bonds: You must pay tax on interest annually even though you don't receive it until ...

ZERO COUPON BONDS - Tax Liability in special Circumstances / Specific ... TION 36 (1) (iiia) For the purposes of section 36 (1) (iiia), the pro-rata amount of discount on a zero coupon bond shall be computed as under: Step-I:- Compute Total Discount as under: Amount payable by company on redemption or maturity of bonds - Amount received by company at the time of issue of bond Step-II:- Compute period of life of bond ...

How are Bonds Taxed Under the Income Tax Act? - Wint Wealth Types of Bonds and Their Taxation . There are different types of bonds in the market. Let us look at their types and taxation. 1. Zero-Coupon Bonds . Zero-coupon bondholders are liable to only capital gain tax as they do not provide any interest income. However, these are issued at a discount. Hence, the difference is taxed as capital gain. 2.

How Are Corporate Bonds Taxed? - Investopedia On the other hand, there are zero-coupon bonds that have tax implications. These bonds are sold at a deep discount, relative to other bonds as they do not pay any interest or coupons. At maturity ...

› money › income-taxZero Coupon Bonds: Know tax rules when such a bond is held ... Sep 22, 2022 · The tax rules change, depending on the holding period, amount of gains or loss. In bond terms, coupon rate means the rate of interest offered on a bond. As the coupon rate of a zero coupon bond is ...

› terms › zZero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

:max_bytes(150000):strip_icc():gifv()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "44 zero coupon bonds tax"