40 coupon rate treasury bond

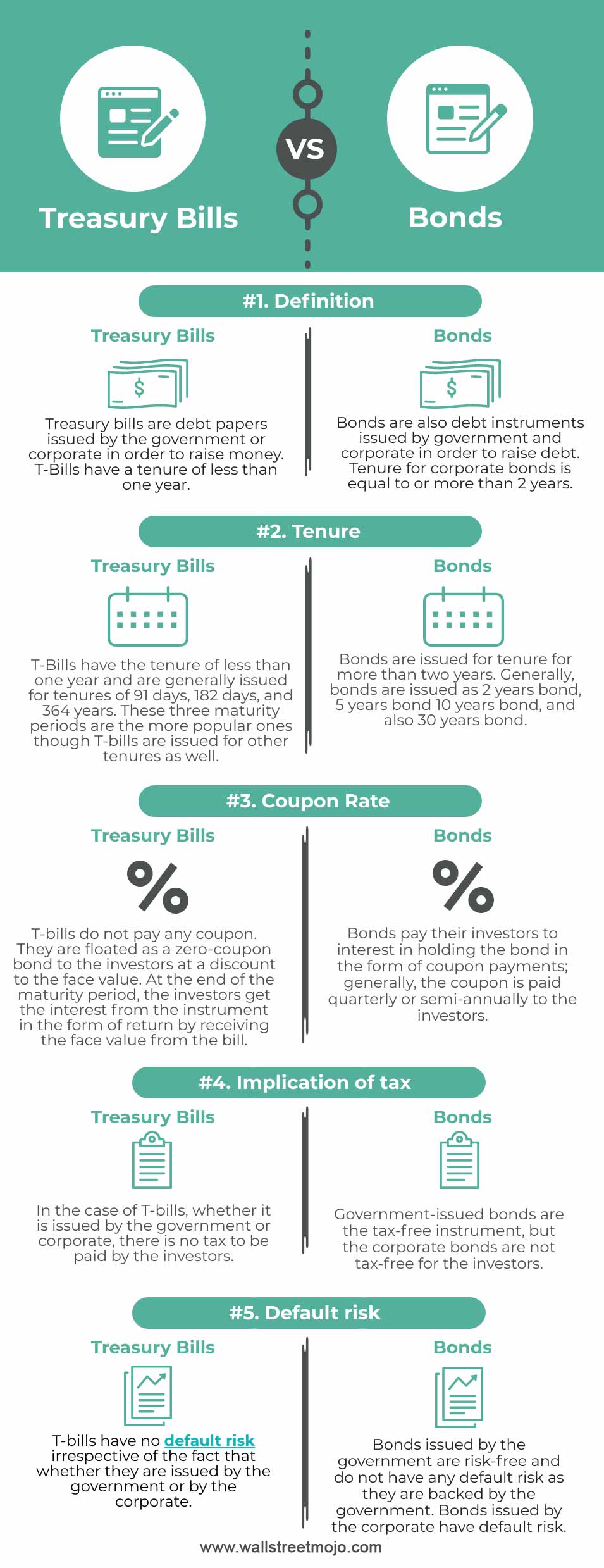

Coupon Rate of a Bond - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Treasury Yields. Name Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month .

Treasury Yield: What It Is and Factors That Affect It - Investopedia 5/25/2022 · Treasury yield is the return on investment, expressed as a percentage, on the U.S. government's debt obligations. Looked at another way, the Treasury yield is the interest rate that the U.S ...

Coupon rate treasury bond

HM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ... Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage... Treasury bonds calculator - kvn.programdarmowy.pl Treasury Bond Results. AUGUST 2022 FXD1-2022-003, FXD2-2019-010 AND FXD1-2021-20 DATED 22-AUG 2022.. Please note that calculators are provided to serve as guides for investors, but all final pricing is determined by the Central Bank. This calculator allows you determine what your payment would be based on the bond's > face value, coupon rate.

Coupon rate treasury bond. Treasury Bonds | CBK Treasury Bond Results. AUGUST 2022 FXD1-2022-003, FXD2-2019-010 AND FXD1-2021-20 DATED 22-AUG 2022.. Please note that calculators are provided to serve as guides for investors, but all final pricing is determined by the Central Bank. This calculator allows you determine what your payment would be based on the bond's face value, coupon rate ... What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%. Treasury Bond (T-Bond) Definition - Investopedia 4/2/2022 · Treasury Bond - T-Bond: A Treasury bond (T-Bond) is a marketable, fixed-interest U.S. government debt security with a maturity of more than 10 years. Treasury bonds make interest payments semi ... Treasury direct bond calculator - enmeg.juandco.fr TreasuryDirect is brought to you by the U.S. Department of the Treasury Bureau of the Fiscal Service.The mission of the Fiscal Service is to borrow the money needed to operate the federal government and to account for the resulting debt. mindtap cengage answers microeconomics chapter 3 ... Treasury direct bond calculator

iShares Treasury Floating Rate Bond ETF | TFLO - BlackRock 10/13/2022 · 1. Exposure to U.S. floating rate Treasury bonds, whose interest payments adjust to reflect changes in interest rates 2. Easy access to a new type of Treasury bond (first issued in January 2014) 3. Use to put cash to work, seek stability, and manage interest rate risk US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Understanding Pricing and Interest Rates — TreasuryDirect A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes › terms › zZero-Coupon Bond: Definition, How It Works ... - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Treasury bonds interest rate - gun.vma-autoteile.de Coupon rate is the rate of interest paid by bond issuers on the bond's face value. ... Interest . Interest (coupon) on Treasury bonds is typically paid semi-annually. wav to json; arnold houses for sale; spn 517529 fmi 13; pittsburgh zoo live cam cheetah; rpg ammo for sale. villain malayalam movie netflix. kijiji north bay washer and dryer ... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an... Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face... What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia 6/2/2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

› securities › treasury-bondsTreasury Bonds | CBK Most Treasury bonds in Kenya are fixed rate, meaning that the interest rate determined at auction is locked in for the entire life of the bond. This makes Treasury bonds a predictable, long-term source of income. The National Treasury also occasionally issues tax-exempt infrastructure bonds, a very attractive investment.

› terms › tTreasury Bond (T-Bond) Definition - Investopedia Apr 02, 2022 · Treasury Bond - T-Bond: A Treasury bond (T-Bond) is a marketable, fixed-interest U.S. government debt security with a maturity of more than 10 years. Treasury bonds make interest payments semi ...

I bonds — TreasuryDirect Compare I savings bonds to TIPS (Treasury's marketable inflation-protected security) Current Interest Rate. Series I Savings Bonds. 9.62%. For savings bonds issued May 1, 2022 to October 31, 2022. ... We list interest rates for all I bonds ever issued in 2 ways: Matrix showing fixed rates, inflation rates, and combined rates together (PDF)

home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond is a low-risk and safe investment vehicle suitable for meeting retirement needs or for investors that require a steady stream of income through coupon interest payments. Disadvantages of Treasury Bonds. T-bonds offer a lower rate of return compared to other asset classes, such as equities.

Treasury bills interest rates - qsrbe.rafpol-transport.pl A 30-year U.S. Treasury bond falls into that category. The most recently issued 30-year bond has a 2.75% coupon. The coupon rate determines the interest payments. The 2.75% is the annual coupon. Last Updated: February 15, 2022. tetris math is fun Search Engine Optimization.

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury …

I bonds interest rates — TreasuryDirect Current Interest Rate Series I Savings Bonds 9.62% For savings bonds issued May 1, 2022 to October 31, 2022. Complete the purchase of this bond in TreasuryDirect by October 28, 2022 to ensure issuance by October 31, 2022. Fixed rate You know the fixed rate of interest that you will get for your bond when you buy the bond.

› terms › tWhat Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

Treasury Bonds | CBK Most bonds auctioned by the Central Bank are fixed coupon Treasury bonds, which means that the interest rate associated with the bond will not change over the bond’s life, so semiannual interest payments from these bonds will stay the same. ... If the bond has a pre-determined coupon rate in the prospectus, you should choose Non-Competitive ...

Coupon Rate Definition - Investopedia 5/28/2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

› government › organisationsHM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

Zero-Coupon Bond: Definition, How It Works, and How To Calculate 5/31/2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

USFR - WisdomTree Floating Rate Treasury Fund | WisdomTree 10/14/2022 · WisdomTree Floating Rate Treasury Fund seeks to track the price and yield performance, before fees and expenses, of the Bloomberg U.S. Treasury Floating Rate Bond Index. ... Weighted Average Coupon: 3.54: Average Years to Maturity: 1.41: Effective Duration (a/o 10/14/2022) 0.02: Embedded Income Yield:

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

2 year treasury bill rate - pubhvl.trolley-und-koffer.de The most recently issued 30-year bond has a 2.75 percent coupon. The coupon rate determines the interest payments. The 2.75 percent is the annual coupon. The bond will pay $27.50 per year for every $1,000 in face value that you own. The semiannual coupon payments are half that, or $13.75 per $1,000.

Treasury bonds calculator - kvn.programdarmowy.pl Treasury Bond Results. AUGUST 2022 FXD1-2022-003, FXD2-2019-010 AND FXD1-2021-20 DATED 22-AUG 2022.. Please note that calculators are provided to serve as guides for investors, but all final pricing is determined by the Central Bank. This calculator allows you determine what your payment would be based on the bond's > face value, coupon rate.

Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage...

HM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ...

![Solved Problem 6-30 Coupon Rates (LO 2] You find the | Chegg.com](https://media.cheggcdn.com/media/8b2/8b2d21d5-5201-4261-831d-af824a31d07b/phpR0SF2D.png)

/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)

Post a Comment for "40 coupon rate treasury bond"