43 government zero coupon bonds

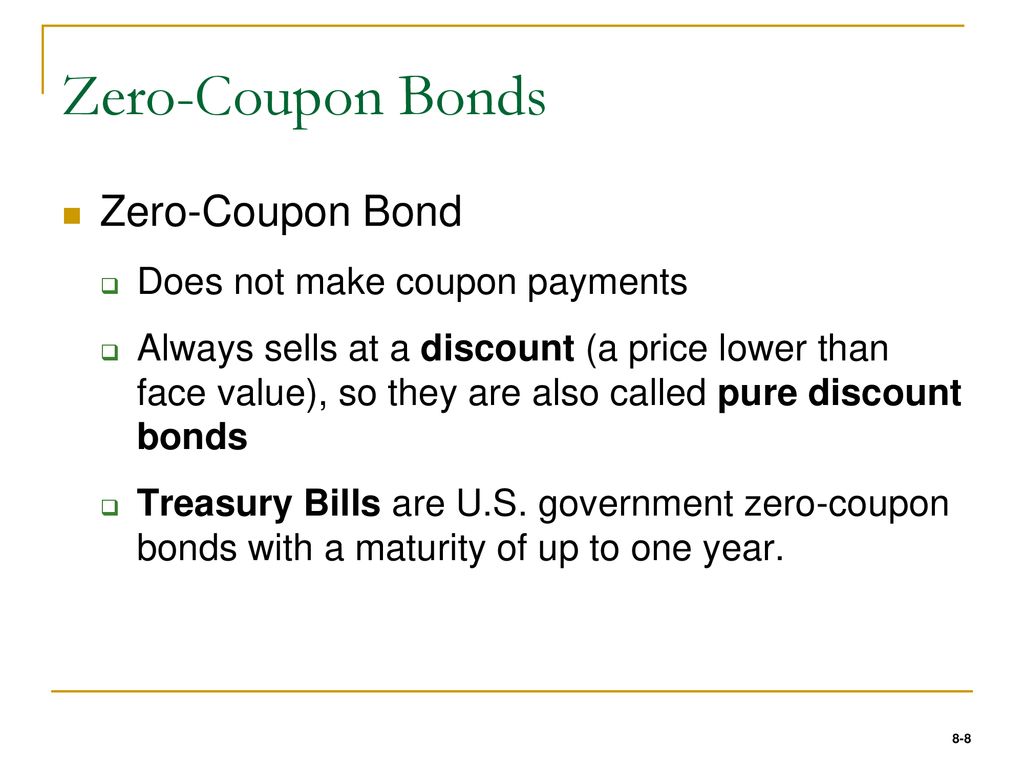

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ... Coupon (finance) - Wikipedia Normally, to compensate the bondholder for the time value of money, the price of a zero-coupon bond will always be less than its face value on any date before the maturity date. During the European sovereign-debt crisis, some zero-coupon sovereign bonds traded above their face value as investors were willing to pay a premium for the perceived ...

Zero-Coupon Bonds and Taxes - Investopedia Aug 31, 2020 · Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion.

Government zero coupon bonds

List of government bonds - Wikipedia TEC10 OATs - floating rate bonds indexed on constant 10year maturity OAT yields; OATi - French inflation-indexed bonds; OAT€i - Eurozone inflation-indexed bonds; Agence France Trésor Germany. Issued By: German Finance Agency, the German Debt Agency Bunds. Unverzinsliche Schatzanweisungen (Bubills) - 6 and 12 month (zero coupon) Treasury ... Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. Australia Government Bonds - Yields Curve Oct 24, 2022 · The Australia 10Y Government Bond has a 4.162% yield.. 10 Years vs 2 Years bond spread is 62.9 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.60% (last modification in October 2022).

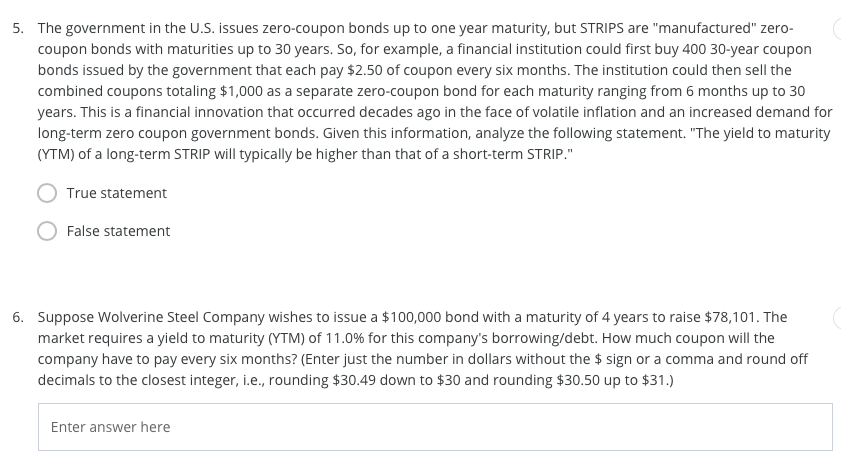

Government zero coupon bonds. What Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Australia Government Bonds - Yields Curve Oct 24, 2022 · The Australia 10Y Government Bond has a 4.162% yield.. 10 Years vs 2 Years bond spread is 62.9 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.60% (last modification in October 2022). Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. List of government bonds - Wikipedia TEC10 OATs - floating rate bonds indexed on constant 10year maturity OAT yields; OATi - French inflation-indexed bonds; OAT€i - Eurozone inflation-indexed bonds; Agence France Trésor Germany. Issued By: German Finance Agency, the German Debt Agency Bunds. Unverzinsliche Schatzanweisungen (Bubills) - 6 and 12 month (zero coupon) Treasury ...

10.png)

Post a Comment for "43 government zero coupon bonds"