39 are treasury bills zero coupon bonds

How To Buy Treasury Bonds And Buying Strategies To Consider 28.9.2022 · With U.S. Treasury bond yields zooming higher, the interest in buying Treasury bonds has followed suit. Let me show you how to buy Treasury bonds online. I’ll then share some buying strategies to help maximize returns and liquidity. Treasury bonds are risk-free investments if you hold them until maturity. Treasury bonds are issued by the United States federal government to … US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

What Are Treasury Bills (T-Bills) and How Do They Work? 2.6.2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

Are treasury bills zero coupon bonds

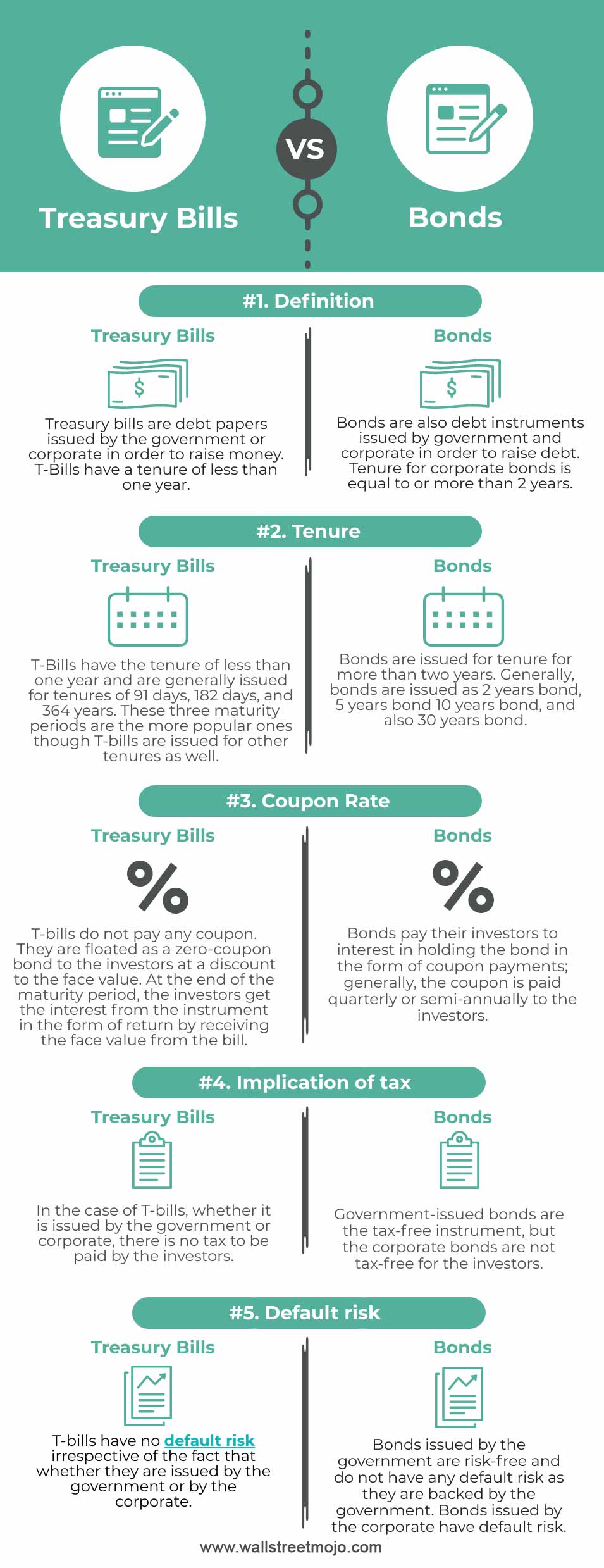

Treasury Bills vs Bonds | Top 5 Best Differences (With Infographics) Treasury bills vs bonds both are financial instruments used in the market to earn additional income or gain and both are backed by the US government. ... Municipal bonds, Corporate bonds, Zero Coupon bonds etc. Price Fluctuations: Price fluctuates very … Advantages and Risks of Zero Coupon Treasury Bonds 31.1.2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 17, 26 and 52 weeks, each of these approximating a different number …

Are treasury bills zero coupon bonds. Treasury Bonds | CBK 19.9.2022 · Bills & Bonds. Treasury Bills; Treasury Bonds; Macroeconomic Statistics. Balance of Payment Statistics. Foreign Trade Summary; ... ONE YEAR ZERO COUPON, TREASURY BOND ISSUE ZC 3/2008/1: 27/10/2008: FIVE-YEAR FIXED COUPON DISCOUNTED TREASURY BOND ISSUE FXD 4/2008/5 : 29/09/2008: Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... What Are Treasury Securities and How Do They Work? - TheStreet 6.10.2022 · Treasury bills (T-bills): T-bills mature in 1 year or less and do not pay an interest rate, known in the bond world as the coupon rate. Thus, Treasury bills are also known as zero-coupon bonds. Treasury Bonds vs. Treasury Notes vs. Treasury Bills: What's the ... 29.3.2022 · Note Auction: A formal bidding process that is scheduled on a regular basis by the U.S. Treasury. Currently there are 17 authorized securities dealers (primary dealers) that are obligated to bid ...

United States Treasury security - Wikipedia Treasury bills (T-bills) are zero-coupon bonds that mature in one year or less. They are bought at a discount of the par value and, instead of paying a coupon interest, are eventually redeemed at that par value to create a positive yield to maturity.. Regular T-bills are commonly issued with maturity dates of 4, 8, 13, 17, 26 and 52 weeks, each of these approximating a different number … Advantages and Risks of Zero Coupon Treasury Bonds 31.1.2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time. Treasury Bills vs Bonds | Top 5 Best Differences (With Infographics) Treasury bills vs bonds both are financial instruments used in the market to earn additional income or gain and both are backed by the US government. ... Municipal bonds, Corporate bonds, Zero Coupon bonds etc. Price Fluctuations: Price fluctuates very …

Post a Comment for "39 are treasury bills zero coupon bonds"