41 present value formula coupon bond

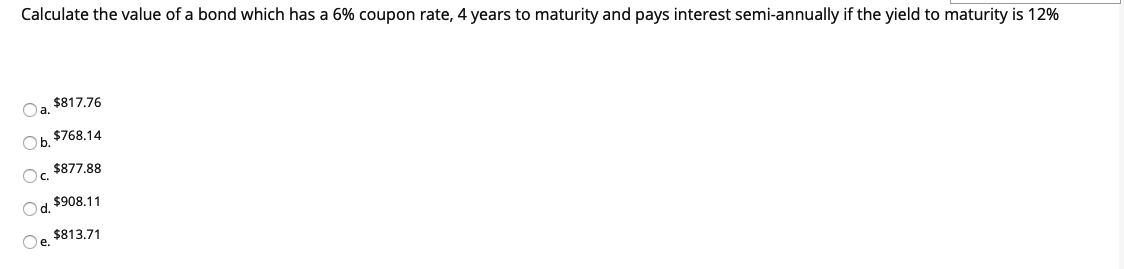

Bond Pricing Formula | How to Calculate Bond Price? | Examples Let us assume a company XYZ Ltd has issued a bond having a face value of $100,000, carrying an annual coupon rate of 7% and maturing in 15 years. The prevailing market rate of interest is 9%. Given, F = $100,000 C = 7% * $100,000 = $7,000 n = 15 r = 9% The price of the bond calculation using the above formula as, Bond price = $83,878.62 Bond Valuation Definition - Investopedia Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the...

Coupon Payment | Definition, Formula, Calculator & Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037. They carry a coupon rate of 6.5% while the payments are made semiannually. Its current yield is 4.63% while its yield to maturity is 3.92%. The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2].

Present value formula coupon bond

Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments) Bond Valuation | Meaning, Methods, Present Value, Example | eFM Present Value n = Expected cash flow in the period n/ (1+i) n Here, i = rate of return/discount rate on bond n = expected time to receive the cash flow This formula will get the present value of each individual cash flow t years from now. The next step is to add all individual cash flows. Calculating the Present Value of a 9% Bond in an 8% Market The present value of a bond's interest payments, PLUS The present value of a bond's maturity amount. The present value of the bond in our example is $36,500 + $67,600 = $104,100. The bond's total present value of $104,100 should approximate the bond's market value.

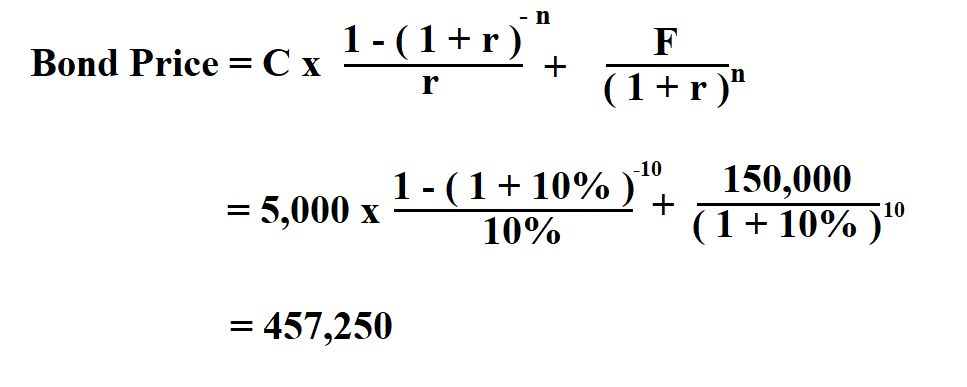

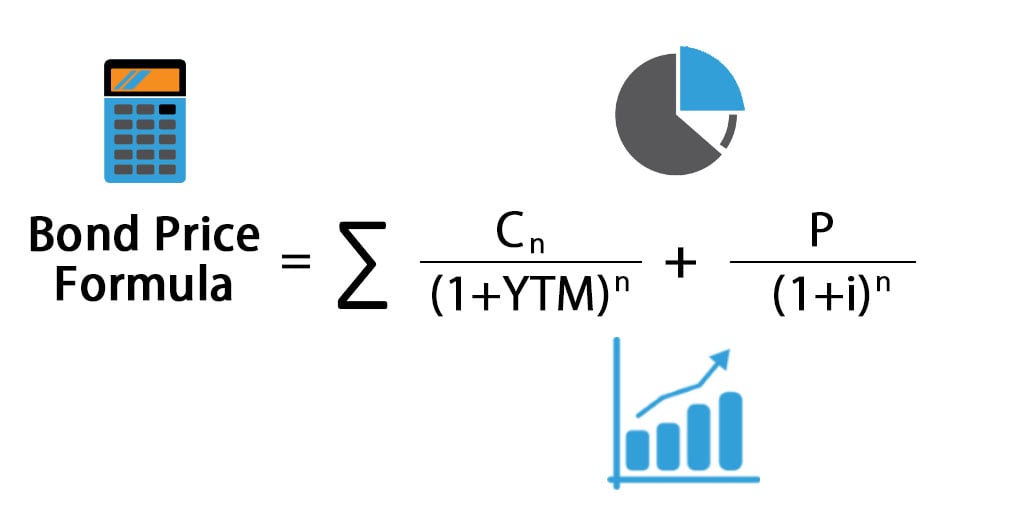

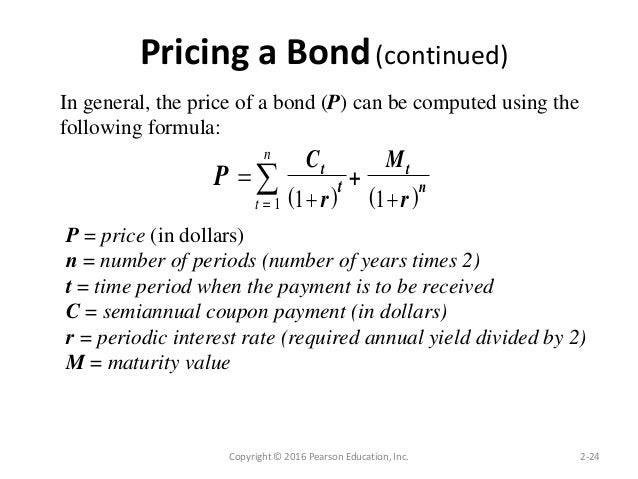

Present value formula coupon bond. How to Calculate the Present Value of a Bond | Pocketsense The final period usually coincides with the maturity date. Required Rate (Rate): the interest rate per coupon period demanded by investors. The formula for determining the value of a bond uses each of the four factors, and is expressed as: Bond Present Value = Pmt/ (1+Rate) + Pmt/ (1+Rate) 2 + ... +Pmt/ (1+Rate) Nper + Fv/ (1+Rate) Nper. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link Coupon Bond Formula | Examples with Excel Template Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033 Coupon Bond Formula | How to Calculate the Price of Coupon Bond? The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n]

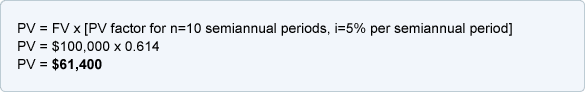

How to Calculate PV of a Different Bond Type With Excel The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate... Bond Formulas - thismatter.com The most common bond formulas, including time value of money and annuities, bond yields, yield to maturity, and duration and convexity. ... Bond Value = Present Value of Coupon Payments + Present Value of Par Value. Duration Approximation Formula; Duration = P-- P + 2 × P 0 (Δy) P 0 = Bond price. How to Calculate Present Value of a Bond - Pediaa.Com Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond Step 2: Calculate Present Value of the Face Value of the Bond How to calculate the present value of a bond - AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor.

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero-Coupon Bond: Formula and Excel Calculator - Wall Street Prep If we input the provided figures into the present value (PV) formula, we get the following: Present Value (PV) = $1,000 / (1 + 3.0% / 2) ^ (10 * 2) PV = $742.47. The price of this zero-coupon is $742.47, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return. Valuing Bonds | Boundless Finance | | Course Hero F = face value, i F = contractual interest rate, C = F * i F = coupon payment (periodic interest payment), N = number of payments, i = market interest rate, or required yield, or observed / appropriate yield to maturity, M = value at maturity, usually equals face value, and P = market price of bond. Bond Formula | How to Calculate a Bond | Examples with Excel ... - EDUCBA PV of kth Periodic Coupon Payment = (C / n) / (1 + r / n) k PV of Face Value = F / (1 + r / n) n*t Step 7: Finally, the bond formula can be derived by adding up the PV of all the coupon payments and the face value at maturity as shown below. Bond Price = C * [ (1 - (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t]

Bond Valuation Overview (With Formulas and Examples) The formula adds the present value of the expected cash flows to the bond's face value's present value. Below is the following formula for our valuation. ... Value of bond = present value of coupon payments + present value of face value Value of bond = $92.93 + $888.49 Value of bond = $981.42. A natural question one would ask is, what does ...

Bond valuation - Wikipedia Below is the formula for calculating a bond's price, which uses the basic present value (PV) formula for a given discount rate. This formula assumes that a coupon payment has just been made; see below for adjustments on other dates. where: F = face value i F = contractual interest rate C = F * i F = coupon payment (periodic interest payment)

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. ... Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%.

Bond Price | Definition, Formula and Example - XPLAIND.com Since the interest is paid semiannually the bond coupon rate per period is 4.5% (= 9% ÷ 2), the market interest rate is 4% (= 8% ÷ 2) and number of coupon payments (time periods) are 20 (= 2 × 10). Hence, the price of the bond is calculated as the present value of all future cash flows as shown below:

Bond Valuation: Formula, Steps & Examples - Study.com A bond's present value (price) is determined by the following formula: Price = {Coupon_1}/ { (1+r)^1} + {Coupon_2}/ { (1+r)^2} + ... + {Coupon_n}/ { (1+r)^n} + {Face Value}/ { (1+r)^n} For example,...

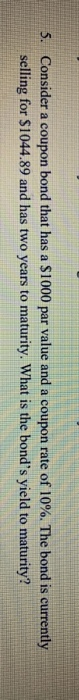

Corporate Bond Valuation - Overview, How To Value And Calculate Yield To calculate the yield, set the bond's price equal to the promised payments of the bond (coupon payments), divide it by one plus a rate, and solve for the rate. The rate will be the yield. An alternative way to solve a bond's yield is by using the "Rate" function in Excel. Five inputs are needed to use the "Rate" function; time left ...

How to Figure Out the Present Value of a Bond - dummies The present value of the bond is $100,000 x 0.65873 = $65,873. The present value of the interest payments is $7,000 x 3.10245 = $21,717, with rounding. Add the present value of the two cash flows to determine the total present value of the bond. In this example, $65,873 + $21,717 = $87,590. About This Article

Excel formula: Bond valuation example | Exceljet =- PV( C6 / C8, C7 * C8, C5 / C8 * C4, C4) The arguments provided to PV are as follows: rate - C6/C8 = 8%/2 = 4% nper - C7*C8 = 3*2 = 6 pmt - C5/C8*C4 = 7%/2*1000 = 35 fv - 1000 The PV function returns -973.79. To get positive dollars, we use a negative sign before the PV function to get final result of $973.79 Between coupon payment dates

Calculating the Present Value of a 9% Bond in an 8% Market The present value of a bond's interest payments, PLUS The present value of a bond's maturity amount. The present value of the bond in our example is $36,500 + $67,600 = $104,100. The bond's total present value of $104,100 should approximate the bond's market value.

Bond Valuation | Meaning, Methods, Present Value, Example | eFM Present Value n = Expected cash flow in the period n/ (1+i) n Here, i = rate of return/discount rate on bond n = expected time to receive the cash flow This formula will get the present value of each individual cash flow t years from now. The next step is to add all individual cash flows.

Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments)

Post a Comment for "41 present value formula coupon bond"